News Update Transfer Pricing

Case Law – Attribution of Capital to a Permanent Establishment

5 augustus 2022

In May 2022, the Dutch Court of Appeal published its judgment (ECLI:NL:GHSHE:2022:1198, in Dutch) in a comprehensive transfer pricing ("TP") case dealing with the attribution of capital to a permanent establishment ("PE"). In this TP News Update, we analyse the Court's main considerations with regard to this topic.

In section 2, we discuss the facts of the case. A summary of the applicable law is provided in section 3. The dispute under review is discussed in section 4. Then, in section 5, the District Court's judgment is outlined and in section 6 the Court of Appeal's judgment is explained. In the last section, section 7, we provide our remarks on these judgments.2. Facts

The main facts of the case are as follows.- The case under review concerns a Dutch corporate income tax ("CIT") assessment issued for the fiscal year 2012.

- The interested party ("X") that lodged the appeal against the District Court's judgment (in Dutch) is a Dutch top holding company of a multinational group ("Group"). X is active in the sale and production of fertilizers and related products. X is the parent company of a fiscal unity (fiscale eenheid) for Dutch CIT purposes, with several subsidiaries.

- X holds an interest in a limited partnership (commanditaire vennootschap, "CV") incorporated under the laws of the Netherlands. This CV operated a fertilizer plant in Libya. During the period in which it was operating the plant, a civil war broke out.

- For Dutch tax purposes, the CV is transparent. This means that the shares in the CV are considered to result in a foreign PE of the fiscal unity.

- X had contributed capital with a value of approximately EUR 175 million and know-how to the CV. The contributed capital was fully financed with a loan ("Loan") granted by a related party.

- The overall average interest rate of the fiscal unity (i.e. the 'general enterprise') was 4.6%. The fiscal unity's capital structure consisted of 53% equity and 47% debt (Court of Appeal judgment, par. 2.16, in Dutch).

3. Applicable law: source exemption and fiscal unity

Source exemption and capital attributionBefore we start analysing the case, it is useful to provide some insights into the Dutch source exemption for foreign business profits (objectvrijstelling) and how profits should be attributed to a foreign PE in order to exempt these profits in accordance with Article 15e of the Dutch Corporate Income Tax Act (Wet op de vennootschapsbelasting, "CITA"). According to the source exemption, results originating from a PE in another country are exempt from the Dutch CIT base of the taxpayer, being the fiscal unity in this case. The source exemption for foreign business profits is the 'Dutch translation' of the exemption method of Article 23a of the OECD Model Tax Convention.

The 2022 Dutch Decree on Profit Attribution to Permanent Establishments (Besluit winstallocatie vaste inrichtingen, "PE Decree", in Dutch) aims to align the Dutch policy for allocating profits to a PE with the 2010 OECD Report On The Attribution of Profits to Permanent Establishments ("PE Report"). The PE Report recommends the Authorised OECD Approach, based on which the PE should be attributed the arm's length profits as if it were a separate and independent enterprise engaged in the same or similar activities under the same or similar circumstances. This is also referred to as the "functionally separate entity approach". In making the attribution in question, the functions performed, assets used and risks assumed by the foreign enterprise and other parts of the enterprise are taken into account.

The PE Decree considers the 'capital allocation approach' in combination with the 'fungibility approach' as the best method to determine the allocation of free capital. The capital allocation approach follows the actual capital structure of the general enterprise and builds on the premise that the creditworthiness of the PE is in principle equal to the creditworthiness of the general enterprise that it is part of. Under this approach, capital (i.e. debt and equity) is attributed to the PE on the basis of the proportion of assets and risks attributed to the PE by the functional analysis. Subsequently, interest expenses are allocated to the PE based on the fungibility approach. Based on the attributed debt to the PE, the fungibility approach leads to a pro rata allocation of the total interest expenses of the general enterprise (i.e. based on the proportion of debt allocated to the PE).

Fiscal unity

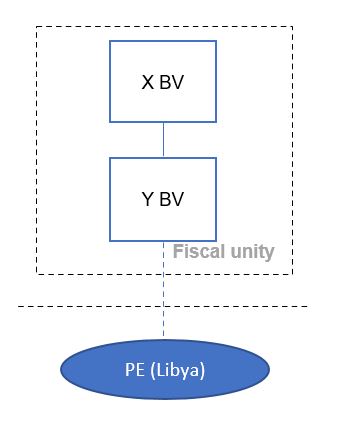

In accordance with Article 15 CITA, a parent company and its Dutch subsidiaries can form a fiscal unity when certain conditions are fulfilled. In cases where such a fiscal unity exists, the activities, assets and liabilities of the subsidiaries are allocated to the parent company. The Dutch CIT regime treats the fiscal unity as a single taxpayer.

The fiscal unity regime provides for some special rules with regard to PEs. Prior to 2018, the fiscal unity was seen as the head office, and the source exemption was therefore applied at the level of the fiscal unity (Article 15ac(4) CITA). Accordingly, the creditworthiness and, subsequently, the capital structure of the fiscal unity had to be taken into account for the attribution of capital. However, with effect from 1 January 2018, the entity that 'holds' the PE is instead considered as the head office and, thus, the creditworthiness of this entity is used as starting point for the allocation of debt and equity to the PE (Article 15ac(5) CITA).

The example below shows the difference between the law applicable before and after 1 January 2018. In this example, the capital structure is as follows:

- Fiscal unity (NL): 50% debt and 50% equity;

- X BV: 60% debt and 40% equity; and

- Y BV: 40% debt and 60% equity.

Prior to 2018

To allocate debt and equity to the PE, the creditworthiness and, subsequently the capital structure of the fiscal unity was taken into account. Therefore, the PE had in principle a capital structure (i.e. debt-equity ratio) of 50/50.

With effect from 2018

To allocate debt and equity to the PE, the creditworthiness and subsequently the capital structure of Y BV (i.e. the entity that directly 'holds' the PE) is taken into account. Therefore, the PE has in principle a capital structure (i.e. debt-equity ratio) of 40/60.

4. Dispute

The case under review concerned the attribution of capital to the PE (i.e. the CV) in relation to the application of the Dutch source exemption for foreign business profits.Both X and the Dutch Tax Authorities ("DTA") agreed that the CV's results constituted profits originating from a foreign PE, and which qualified for application of the Dutch source exemption for business profits pursuant to Article 15e CITA. However, the parties disagreed on the amount of capital to be attributed to the PE.

X (i.e. the parent company of the fiscal unity and, also, the head office of the PE) attributed the total amount of the Loan to the head office. Accordingly, X did not allocate any interest expenses to the PE. X argued that the Loan had been granted and was, thus, attributable to the fiscal unity rather than to the CV (i.e. the PE). Furthermore, X was of the opinion that it was impossible to find an independent enterprise that would have been willing to provide a loan to the CV, due to the civil war in Libya.

The DTA did not agree with X's point of view. Initially, the DTA applied a tracing approach (historische methode) and allocated the total amount of the Loan to the PE. However, during the procedure, the DTA acknowledged that this approach was incorrect and agreed with X that the allocation of capital should be based on the risks assumed by the PE and the head office. The DTA argued that the PE had a higher risk profile due to the critical security situation caused by the civil war. According to the DTA, the PE's higher risk profile allowed for a correction of 22% to the overall creditworthiness of the fiscal unity for the purpose of determining the capital structure of the PE. This correction was applied to determine the PE's adjusted ability to borrow relative to the fiscal unity. Therefore, the DTA believed that an appropriate capital allocation to the PE amounted to 25% debt and 75% equity, as opposed to the 47% debt and 53% equity that was in place at the level of the fiscal unity.

5. District Court

The District Court concurred with the DTA's point of view and considered that it was right to take the creditworthiness of the head office (i.e. fiscal unity) as the starting point for the attribution of capital to the PE. Furthermore, the Court found that the correction of 22% for the increased risk profile of the PE was 'not wrong'. The Court therefore held that an attribution of 75% equity and 25% debt to the PE was appropriate. In addition, the Court ruled that the applicable interest rate was the average interest rate payable at the level of the fiscal unity, i.e. 4.6%.Furthermore, the District Court ruled that the source exemption for foreign business profits should be applied at the level of the fiscal unity, whereas the DTA had been of the opinion that the source exemption had to be applied at the level of the entity that directly 'held' the PE. The District Court's conclusion in this respect is in line with the Dutch law applicable prior to 2018, as set out in section 3.

6. Court of Appeal

X did not agree with the judgment of the District Court and filed an appeal with the Dutch Court of Appeal. Before the Court of Appeal, X presented the following three arguments in substantiation of its claim that the District Court's judgment was wrong:- the Loan was granted to an entity of the fiscal unity and not to the CV (i.e. the PE);

- due to the civil war, an independent party would not have been willing to grant a loan to the CV; and

- the debt-equity ratio that the District Court used as its starting point was wrong. According to X, the stock market value of the capital was a more appropriate basis. This would leave the PE with a capital structure of 7% debt and 93% equity.

Court of Appeal judgment

The Court of Appeal started its judgment by outlining the applicable law and regulations applying to the allocation of capital to a PE. The Court of Appeal considered the standards under the OECD Model Tax Convention relevant for the allocation of debt and equity between head offices and PEs, even though there was no tax treaty in place at the time between the Netherlands and Libya. The Court of Appeal justified this decision by referring to the parliamentary history in which the Dutch legislature indicated that they recommended following the OECD Model Tax Convention when calculating the profit attributable to PEs, even in cases where no tax treaty was in place (see Kamerstukken II 2011/12, 33 003, no. 3, p. 96). Consequently, in line with the PE Decree, which is based on the OECD's PE Report, the Court of Appeal considered the capital allocation approach in conjunction with the fungibility approach as the preferred bases for the allocation of profits to PEs.

In line with the capital allocation approach, the Court of Appeal also stated that the PE had, in principle, the same creditworthiness as the head office, provided that the functions, assets and related risks attributed to the PE were taken into account appropriately. Therefore, the Court of Appeal did not overturn the decision of the District Court to the extent that the latter used the creditworthiness of the head office as a starting point.

Furthermore, the Court of Appeal ruled as follows on X's three main arguments.

1. First argument

With regard to X's first argument, the Court of Appeal made it clear that the legal attribution of loans was not relevant for the PE's capital attribution when applying the capital allocation approach. The Court of Appeal stated that this legal attribution was only relevant for the separate entity approach of Article 9 of the OECD Model Tax Convention, which deals with the application of the arm's length principle between related enterprises. The Court of Appeal found this article not applicable in the case under review, because the wording of the Dutch source exemption for foreign business profits seeks to align with Article 7(2) of the OECD Model Tax Convention.

For this reason, the Court of Appeal ruled that argument (i) lacked merit.

2. Second argument

The Court of Appeal also ruled that the question whether an independent third party would have granted a loan to the PE was irrelevant under the capital allocation method. This decision was based on the same reason as that set out under argument (i), i.e. the question was only relevant for the separate entity approach deriving from Article 9 of the OECD Model Tax Convention.

Therefore, argument (ii) failed as well.

3. Third argument

X's third argument related to the 22% adjustment that the District Court found appropriate.

In this respect, the Court of Appeal agreed with the District Court that the creditworthiness (i.e. capital structure) of the fiscal unity formed the starting point under the capital allocation approach for attributing capital to the PE. In addition, the Court of Appeal saw no reason to apply an exception to this rule. Leaving the political and social situation in Libya aside, the Court of Appeal justified this by stating that the fertilizer plant operated by the PE was very similar to other plants of the Group in terms of functions, assets and risks. According to the Court of Appeal, X failed to show that the risks associated with the PE's plant, e.g. because of a lower level of maintenance, were greater than those associated with other plants operated within the fiscal unity.

However, the Court of Appeal found that the capital allocation approach allows for a correction due to general circumstances that prevailed in the PE's jurisdiction and increased the business risk, in line with the PE Report. After all, without such a correction, application of the capital allocation approach would not result in an arm's length outcome. Therefore, the Court of Appeal agreed with the District Court that a correction to the general creditworthiness should be applied in view of the impact of the outbreak of the civil war in Libya. The Court of Appeal ruled that X had not sufficiently substantiated its argument that a correction of 22% was insufficient. In this respect, the Court of Appeal also considered and relied on the fact that the fertilizer plant had resumed its operations in the second half of 2012.

Hence, the Court of Appeal did not uphold X's third argument that 7% debt and 93% equity was more appropriate.

In summary, the Court of Appeal ruled that allocation of 25% debt and 75% equity to the PE based on the capital allocation approach was appropriate. Furthermore, it also confirmed that applying a 4.6% interest rate and calculating an interest expense for the PE based on the fungibility approach could be considered in line with the arm's length principle. The Court of Appeal thus upheld the judgment of the District Court.

7. Our remarks

There are some noteworthy aspects regarding the allocation of debt and equity arising from this case. In the section below, we discuss some of these aspects, specifically: (a) confirmation of the capital allocation approach, (b) application of the source exemption for foreign business profits in relation to the fiscal unity regime, (c) the country risk adjustment for TP purposes and (d) the irrelevance of the legal attribution of loans to PEs and whether an independent third party would have granted a loan to the PE.a. Confirmation of the capital allocation approach

First of all, it is important to clarify the legal status of the PE Decree. The PE Decree reflects the view of the Dutch State Secretary of Finance with regard to the profit allocation to PEs. Generally, the DTA is not allowed to deviate from the views expressed in Decrees if such deviation would be unfavourable to the taxpayer (Para. 2 Tax (Administrative Law) Decree (Besluit Fiscaal Bestuursrecht)). In other words, if the law allows for a different interpretation than provided by the PE Decree, Dutch taxpayers can choose the approach that is most beneficial to them. In this respect, the DTA can only deviate from the provisions in the PE Decree if they would lead to double non-taxation (Para. 1.3 PE Decree).

Such an alternative interpretation exists regarding the allocation of debt and equity to a PE, since the Dutch Supreme Court has indicated before (i.e. in a case decided in 2004 (in Dutch) and in another case in 2005 (in Dutch)) that a tracing approach (historische methode) needs to be applied for the allocation of debt.

However, in the light of the circumstances of the case under review, the tracing approach would have resulted in a total allocation of the Loan to the PE and would therefore have been disadvantageous for X to rely on. The DTA initially tried to apply the tracing approach, but eventually adopted the capital allocation approach instead. Considering the legal status of the Decree, the DTA would ultimately not have been able to justify applying the tracing approach.

The District Court also applied the capital allocation approach but it did not explicitly mention this. The Court of Appeal, on the other hand, explicitly confirmed the applicability of the capital allocation approach. In doing so, both courts confirmed the capital allocation approach as the most appropriate method for the attribution of capital to PEs.

b. The fiscal unity as head office

Secondly, another interesting aspect of this case is the Courts' consideration of the head office, i.e. the level at which the source exemption is applied. A key issue here is whether the head office is seen as the fiscal unity as a whole or only as the entity which is part of that fiscal unity and directly 'holds' the PE. Since this case applies to the fiscal year 2012 and, therefore, before the amendment of the law with effect from 1 January 2018 as referred to in paragraph 3, it is no surprise that both Courts held that the fiscal unity had to be treated as the head office.

c. Relevance of country risk adjustment for TP purposes

Thirdly, this case re-confirms that the general circumstances (e.g. economic, social and political) prevailing in jurisdictions can allow for adjustments when applying the arm's length principle. In this case, the civil war that broke out in Libya led to an adjustment of 22% to the fiscal unity's capital structure for the attribution of capital to the PE.

The amount of the adjustment seems arbitrary, but a taxpayer is free to provide evidence that leads to a different adjustment. Although it how a taxpayer could provide such evidence is not cast in stone, we highly recommend performing additional analysis (e.g. using a benchmarking study or justifications provided by credit rating agencies) in order to demonstrate that another adjustment would be more appropriate and in line with the arm's length principle.

d. Capital allocation approach vs functionally separate entity approach

Finally, as mentioned in section 6, the Court of Appeal ruled that the legal attribution of loans, and the question whether independent enterprises would have granted a loan to the PE under the same circumstances, were not relevant in the context of the allocation of debt and equity to a PE. This conclusion seems in line with the OECD's view on this topic as stated in par. 14 of the PE Report (p. 14):

"The factual, legal position in a PE context, on the other hand, is that there is no single part of an enterprise which legally 'owns' the assets, assumes the risks, possesses the capital or contracts with separate enterprises. The legal position is thus unhelpful in a PE context, since Article 7(2) requires the PE to be treated as if it were a separate and independent enterprise, performing its own functions, assuming its own risk and owning or using assets on its own."

Despite the fact that the judgment of the Court of Appeal is in line with the PE Report, it is noteworthy that the capital allocation approach seems to deviate from the functionally separate entity approach in its purest sense. After all, the functionally separate entity approach seeks to attribute profits to the PE as if it were a separate and independent enterprise engaged in the same or similar activities under the same or similar circumstances. With this in mind, it is quite remarkable that the Court of Appeal found the question whether independent enterprises would have granted a loan to the PE under the same circumstances to be irrelevant. Such a comparison with an independent enterprise would in fact seem to align with the core premise of the functionally separate entity approach and, more importantly, with the text of Article 15e(6) of the Dutch CITA (which also refers to the separate entity approach).

All in all, the Court of Appeal's judgment provides thought-provoking insights into the attribution of capital to PEs. The taxpayer has filed an appeal with the Dutch Supreme Court, and we will be following further developments in the case with interest.

Written by: